Trade Analysis and Tips for the British Pound

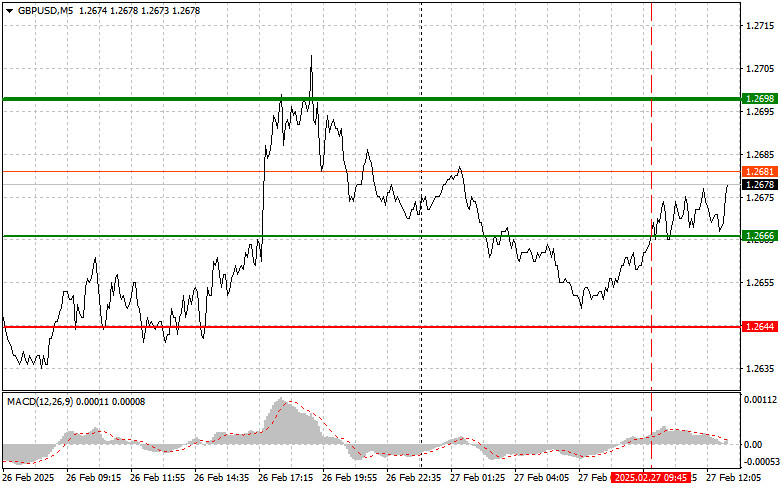

A price test at 1.2666 occurred when the MACD indicator had already moved significantly above the zero mark, limiting the pair's upward potential—especially after yesterday's decline. For this reason, I did not buy the pound and did not miss out on much.

Traders remain cautious, assessing the likelihood of further interest rate cuts by the Bank of England and their impact on economic growth. Overall, market uncertainty persists, though the development of a bullish trend in the pound is more than evident.

I expect some market shifts following the release of key U.S. GDP growth figures and the Personal Consumption Expenditures (PCE) Index. However, it is important to remember that inflation remains stubborn, and despite efforts by the Federal Reserve, it has yet to show a sustainable decline to target levels. This adds further uncertainty and could trigger additional volatility in the currency markets.

Additionally, geopolitical tensions continue to have a significant impact on investor sentiment. Any escalation in trade conflicts can instantly affect risk assets, including the pound.

Today, particular attention should also be paid to the U.S. Initial Jobless Claims data and the Pending Home Sales report. These indicators often serve as a barometer for the state of the U.S. economy. A decline in jobless claims could signal labor market resilience, supporting consumer spending. Conversely, an increase in claims may indicate economic weakening and a potential drop in consumer activity. Regarding pending home sales, a rise suggests growing interest in the real estate market, often a precursor to overall economic expansion. Yesterday's housing market data was disappointing, so we'll see what today's reports bring.

As for my intraday strategy, I will rely primarily on Scenarios #1 and #2.

Buy Signal

Scenario #1

I plan to buy the pound today when the entry point of 1.2685 (green line on the chart) is reached, aiming for an increase toward 1.2711 (thicker green line on the chart). Around 1.2711, I will exit long positions and open short trades in the opposite direction, expecting a 30-35 point pullback from that level. Today's pound rally is likely to continue in line with the ongoing bullish market trend.

Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2

I also plan to buy the pound today if there are two consecutive tests of the 1.2664 level, while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger an upward reversal. Expected targets for the rise: 1.2685 and 1.2711.

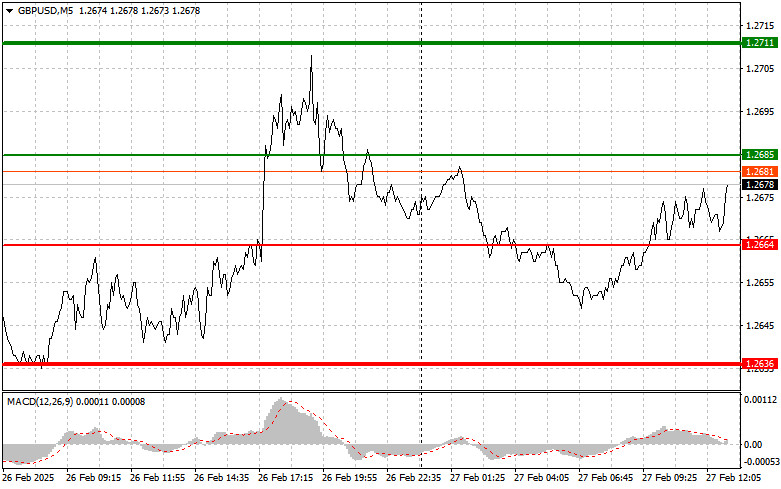

Sell Signal

Scenario #1

I plan to sell the pound today after a break below 1.2664 (red line on the chart), which should lead to a sharp decline in the pair. The key target for sellers will be 1.2636, where I will exit short trades and immediately open long positions in the opposite direction, aiming for a 20-25 point retracement. Sellers are likely to step in if strong U.S. data is released.

Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2

I also plan to sell the pound today if there are two consecutive tests of the 1.2685 level, while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and trigger a downward reversal. Expected targets for the decline: 1.2664 and 1.2636.

Chart Guide:

- Thin green line – Entry price for buying the trading instrument.

- Thicker green line – Suggested price for setting Take Profit or manually securing profits, as further growth beyond this level is unlikely.

- Thin red line – Entry price for selling the trading instrument.

- Thicker red line – Suggested price for setting Take Profit or manually securing profits, as further decline beyond this level is unlikely.

- MACD Indicator – When entering a trade, it is essential to consider overbought and oversold zones.

Important for Beginner Forex Traders:

Be extremely cautious when making entry decisions in the market. Before major fundamental reports, it is often best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss protection, you can quickly lose your entire deposit, especially if you are trading large volumes without risk management.

Lastly, successful trading requires a clear trading plan, similar to the one outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.