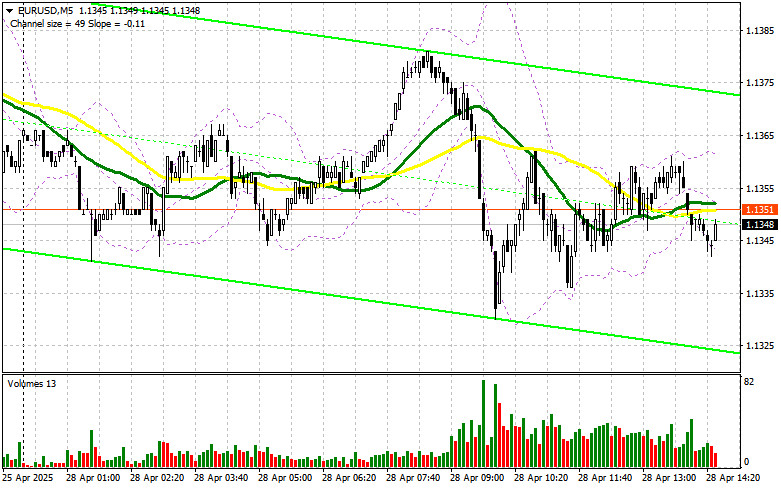

In my morning forecast, I focused on the 1.1391 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. Although there was an upward move, the pair never tested 1.1391, so I stayed out of the market. The technical picture for the second half of the day has been only slightly revised.

To Open Long Positions on EUR/USD:

Traders ignored the economic data during the first half of the day, which was expected, keeping trading within a narrower sideways channel than anticipated. Unfortunately, there are no significant U.S. data releases scheduled for the second half of the day, meaning market volatility could decline even further. For this reason, I would not expect any sharp or directional moves. Perhaps comments from Trump or White House representatives regarding trade tariffs could impact the dollar, so it's better to focus on that.

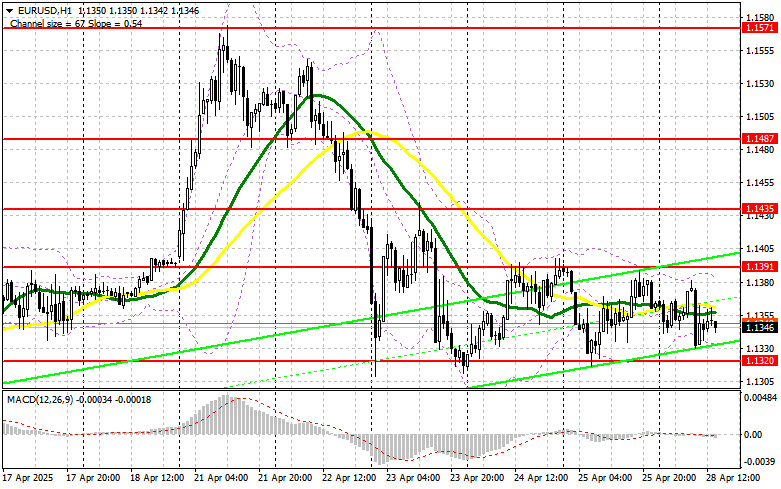

If the pair declines, only a false breakout around the new support at 1.1320 will serve as a reason to buy EUR/USD, aiming for a continuation of the bullish market trend with a target of retesting 1.1391. A breakout and retest of this range will confirm a correct entry point for a move toward 1.1435. The ultimate target remains at 1.1487, where I will be taking profit. If EUR/USD declines and there's no buying interest around 1.1320, the pair will break out of the sideways channel, possibly leading to a stronger downward move. In that case, bears could push the pair down to 1.1267. Only after a false breakout there would I consider buying the euro. Alternatively, I will plan to open long positions immediately after a rebound from 1.1206, aiming for a 30–35 point intraday correction.

To Open Short Positions on EUR/USD:

If the euro rises in the absence of U.S. data, bears will have to assert themselves around 1.1391, which was not reached during the first half of the day. Slightly below are the moving averages, which favor sellers. Only a false breakout at this level will provide a reason to enter short positions targeting the 1.1320 support. A breakout and consolidation below this range will be a suitable selling opportunity toward the 1.1267 area, representing a fairly strong correction. The final target will be the 1.1206 level, where I plan to take profits. If EUR/USD continues to rise in the second half of the day and bears fail to defend 1.1391, buyers could push the pair to update 1.1435. I plan to sell there only after an unsuccessful consolidation. I also plan to open short positions immediately after a rebound from 1.1487, aiming for a 30–35 point downward correction.

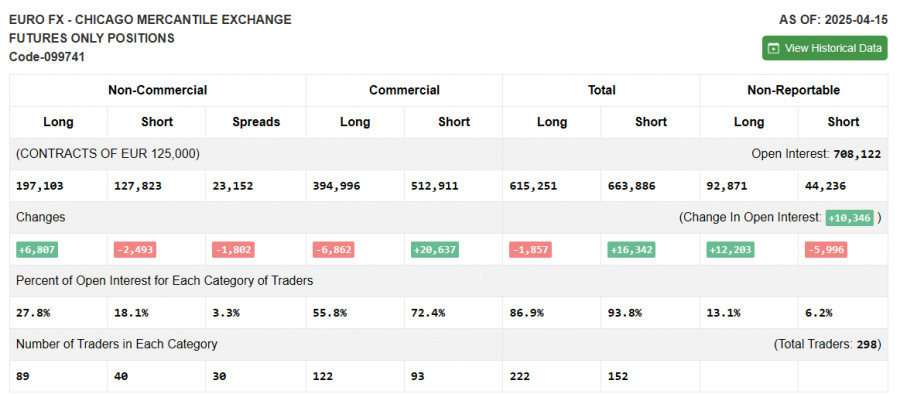

COT Report (Commitment of Traders) for April 15

The COT report showed an increase in long positions and a reduction in shorts. Given that the European Union and the U.S. have made no progress on a trade deal, the euro continues to strengthen while the dollar weakens. According to the COT data, non-commercial long positions rose by 6,807 to 197,103, while short non-commercial positions fell by 2,493 to 127,823. As a result, the gap between long and short positions narrowed by 2,493.

Indicator Signals:

Moving Averages: Trading is taking place around the 30- and 50-day moving averages, indicating market uncertainty.

Note: The periods and prices of moving averages are considered by the author based on the H1 timeframe and differ from the general definition of classical daily moving averages on the D1 timeframe.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.1345 will serve as support.

Indicator Descriptions:

- Moving average: Smooths volatility and noise to define the current trend. Period – 50 (yellow line on the chart);

- Moving average: Period – 30 (green line on the chart);

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12; Slow EMA – period 26; SMA – period 9;

- Bollinger Bands: Period – 20;

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific criteria;

- Long non-commercial positions: The total long open position of non-commercial traders;

- Short non-commercial positions: The total short open position of non-commercial traders;

- Total non-commercial net position: The difference between the short and long positions of non-commercial traders.