The EUR/USD currency pair refrained from continuing its decline on Wednesday. As the saying goes, "Everything in moderation." The dollar gained around 200 pips on Tuesday, which shouldn't scare anyone. Such volatility has become normal for EUR/USD in recent weeks. Thus, we saw not a "2-cent gain over a short period" but "200 pips up after an 1100-pip fall of the U.S. currency." Do those 200 pips look impressive now? What the dollar showed on Tuesday was merely a minor correction.

Let's try to understand the possible reasons. Markets practically exploded when Donald Trump announced that he had no intention of firing Jerome Powell. Now, let's imagine that Trump suddenly said he planned to stop the Earth or put out the Sun. How would the markets react? Probably with indifference because it's simply impossible. The same applies to firing Powell. Trump has no leverage over the Federal Reserve because the Fed is apolitical, and U.S. legislation is designed to prevent anyone from influencing the central bank.

Of course, there are always outlandish scenarios—like accusing Powell of incompetence, insider trading, or even something absurd like murder. But we all understand that no court would find Powell guilty. Therefore, Trump's efforts to remove Powell were pure populism. And the market surely understood that. So, in essence, there shouldn't have been any market reaction—neither to the suggestion of firing Powell nor to the "pardon." Simply because neither is realistically possible.

We can assume that the dollar fell on the same basis of global uncertainty on Monday, and on Tuesday, it corrected for technical reasons. Yes, even during strong upward trends, technical corrections are possible. As we can see, on Wednesday, there was no further decline (i.e., no continued dollar rise). Donald Trump continues to influence the forex market significantly, but it's now hard to say precisely what the market is reacting to. In theory, it could react to almost anything. What if Trump says tomorrow that he plans to bomb China? Would anyone believe it? Would the dollar crash again?

We've often said that Trump's words should be taken with a grain of salt—or better yet, a boulder. His first term should've taught the world that "a promise isn't a guarantee." However, a better saying in Trump's case would be: "The president said something... then changed his mind." So we wouldn't be surprised if, in a few weeks, Trump cancels most of the tariffs, including those on China.

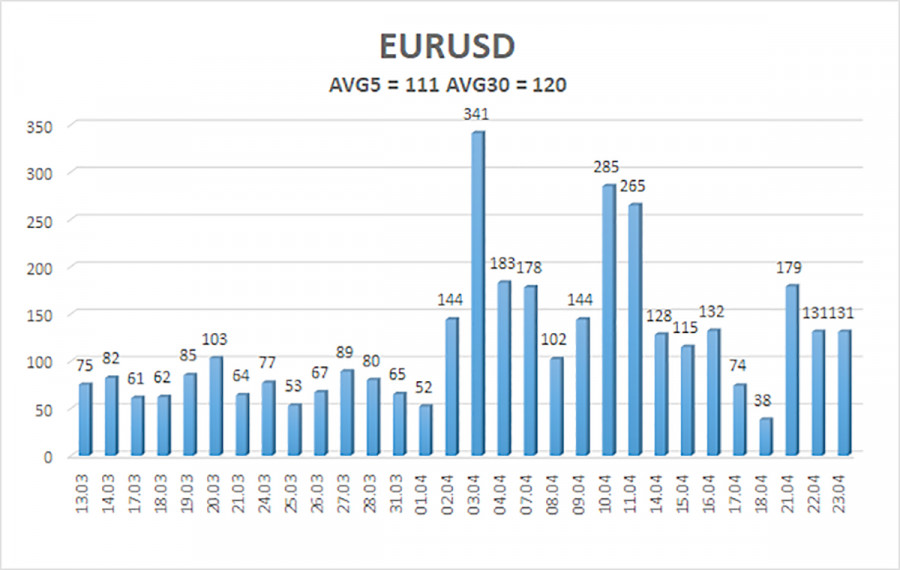

The average volatility of the EUR/USD pair over the last 5 trading days as of April 24 is 111 pips, which is considered "high." We expect the pair to move between levels 1.1258 and 1.1480 on Thursday. The long-term regression channel is pointing upward, indicating a short-term uptrend. The CCI indicator has entered overbought territory three times, signaling the start of a new corrective phase.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.0986

S3 – 1.0742

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1719

R3 – 1.1963

Trading Recommendations:

The EUR/USD pair maintains an upward trend. For months, we've consistently said we expect a medium-term decline in the euro—and that view hasn't changed. The dollar still has no fundamental reason to fall except for Donald Trump. Yet this one factor alone continues to drag the dollar into the abyss. Moreover, it's now entirely unclear what economic consequences this will lead to. When Trump finally stops escalating the trade war, the U.S. economy might already be in poor condition, making a dollar rebound unlikely. If you're trading based on "pure" technicals or "on Trump," then long positions are still viable as long as the price remains above the moving average, with a target at 1.1719.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.