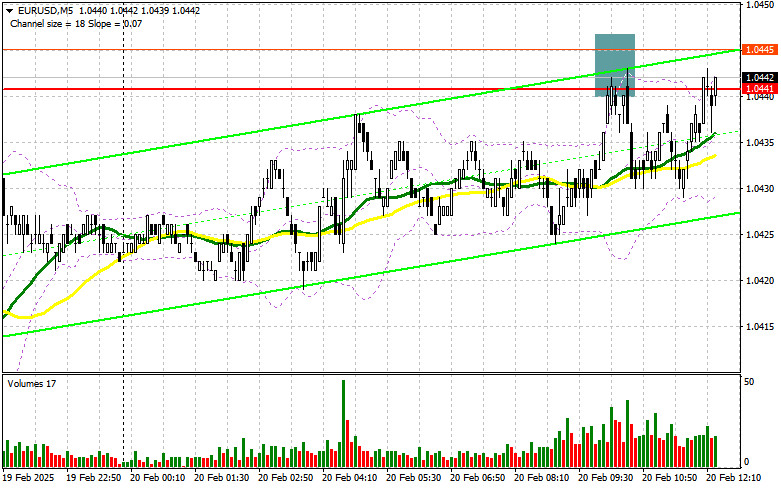

In my morning forecast, I highlighted the 1.0441 level as a key decision point for market entry. Looking at the 5-minute chart, we can see that the pair attempted an upward movement, but a false breakout at 1.0441 provided an entry point for short positions. However, the expected significant decline did not materialize. As a result, the technical outlook for the second half of the day remains unchanged.

Long Position Strategy for EUR/USD

The German Producer Price Index (PPI) had little impact on euro buyers despite slowing inflation growth. Later today, U.S. jobless claims and the Philadelphia Fed Manufacturing Index will be released, but these reports are unlikely to be major market movers. Therefore, traders will shift their focus to FOMC members Austan D. Goolsbee and Michael S. Barr, whose remarks could influence dollar demand.

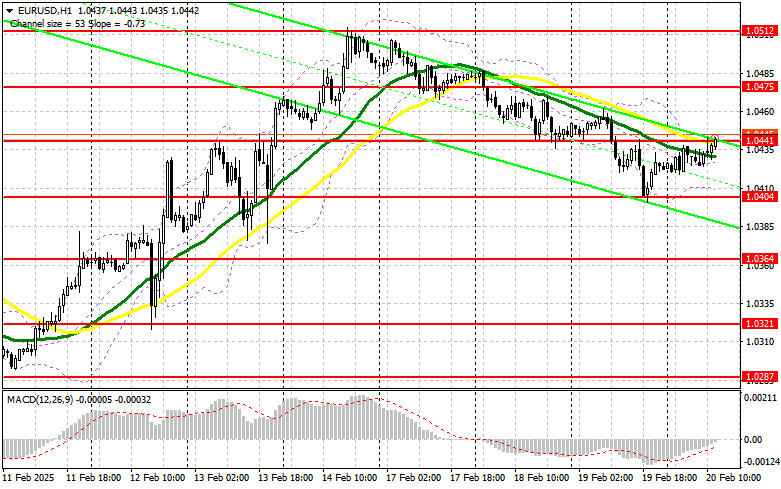

If the euro declines following these speeches, I will consider buying after a false breakout near 1.0404, which could serve as an entry point for an upward move towards 1.0441—a level the pair failed to breach earlier today. A break and retest of 1.0441 would confirm bullish momentum, opening the way to 1.0475 and potentially to the 1.0512 high, where I will secure profits.

If EUR/USD drops and buyers fail to defend 1.0404, this would signal a shift in momentum towards sellers, likely driving the pair down to 1.0364. Only a false breakout at 1.0364 will prompt me to buy again. Direct long positions will only be considered at 1.0321, targeting an intraday correction of 30-35 points.

Short Position Strategy for EUR/USD

Bearish pressure has temporarily faded, putting yesterday's downward correction at risk. Only strong U.S. data or hawkish FOMC comments can reinvigorate dollar buyers.

If the pair rises further, I will focus on defending resistance at 1.0441. Losing this level could mark the return of bullish market sentiment. To confirm the presence of sellers, a false breakout at 1.0441, similar to the one observed earlier, will be needed. This would indicate that large players are positioning for a euro decline, targeting support at 1.0404.

A break and consolidation below 1.0404, especially following strong U.S. data and hawkish FOMC minutes, could trigger stop-loss orders and push EUR/USD towards 1.0364. The final downward target for the day will be 1.0321, where I will lock in profits.

If EUR/USD rises above 1.0441, and sellers fail to react at this level, the next significant resistance lies at 1.0475, where I will consider short positions only after an unsuccessful breakout attempt. If buyers continue to push the pair higher, I will wait until 1.0512 before opening short trades, expecting a 30-35 point downward correction.

Commitment of Traders (COT) Report

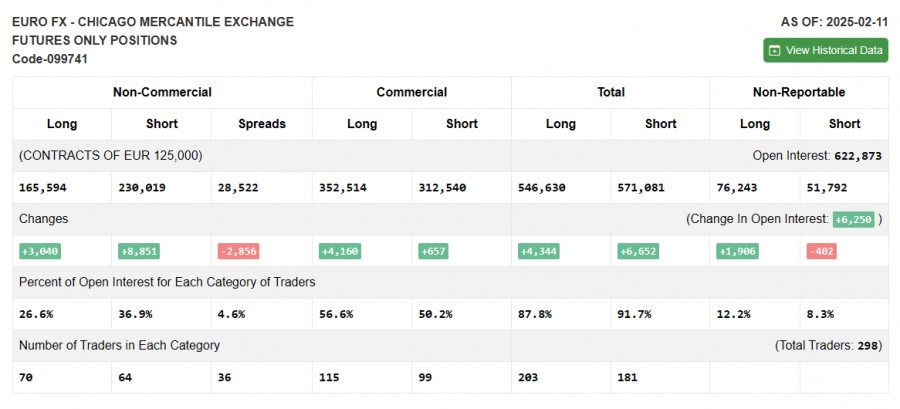

The COT report from February 11 showed an increase in both long and short positions. However, there were fewer euro buyers than sellers. This report does not account for the phone conversation between Putin and Trump, which could have shifted market sentiment toward euro purchases—something that will be reflected in next week's report.

For now, U.S. dollar weakness persists, especially given the lackluster economic data from the U.S. The COT report indicates that long non-commercial positions increased by 3,040 contracts, reaching 165,594, while short non-commercial positions rose by 8,851 contracts to 230,019. As a result, the gap between long and short positions narrowed by 2,856.

Indicator Signals

Moving Averages

EUR/USD is trading near the 30 and 50-day moving averages, indicating market uncertainty.

Bollinger Bands

The lower boundary at 1.0404 serves as the nearest support level in case of a decline.

Indicator Descriptions:

- Moving Average (MA): Identifies trend direction by smoothing out market volatility.

- 50-period MA (yellow line on the chart).

- 30-period MA (green line on the chart).

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period

- Slow EMA – 26-period

- Signal line (SMA) – 9-period

- Bollinger Bands: Measures price volatility (20-period setting).

- Non-commercial traders: Speculators such as individual traders, hedge funds, and institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total number of buy contracts held by non-commercial traders.

- Short non-commercial positions: The total number of sell contracts held by non-commercial traders.

- Net non-commercial position: The difference between long and short positions among non-commercial traders.