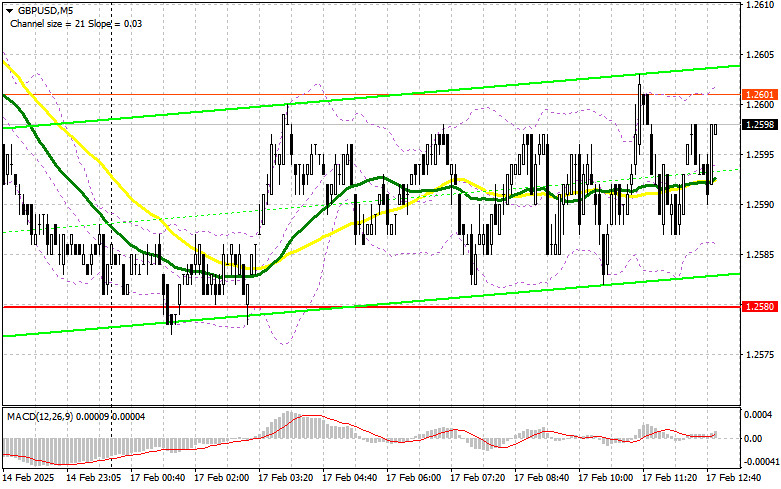

In my morning forecast, I focused on the 1.2580 level and planned to base my market entry decisions on it. Let's analyze the 5-minute chart and see what happened. The pair declined but failed to reach the 1.2580 test. The technical picture for the second half of the day has not been revised.

To Open Long Positions on GBP/USD:

The absence of economic data from the UK has led to a lack of movement in the British pound. In the U.S., Presidents' Day is being observed, making significant volatility unlikely. Only speeches from FOMC members Patrick T. Harker and Michelle Bowman may have some market impact, though this is uncertain.

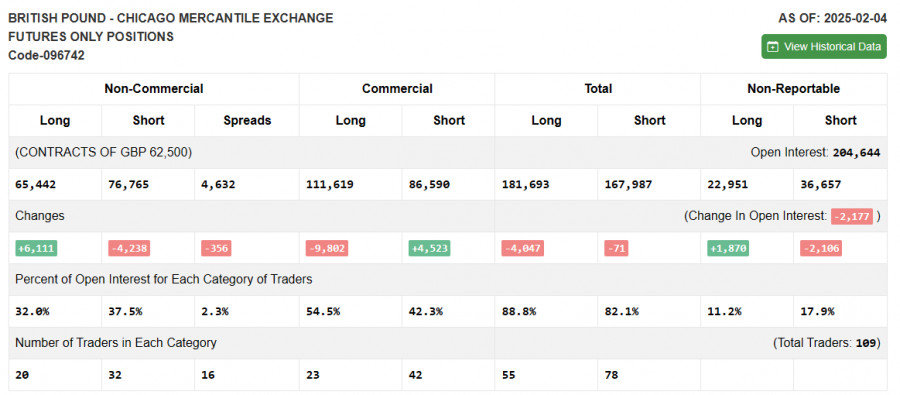

If the pair declines, buyers will need to defend the 1.2580 support level, which I see as a key area. I will consider long positions only after a false breakout at this level, aiming for a rise toward 1.2627, a resistance level formed at the end of last week. A breakout and retest of this range from above would confirm a buying entry, targeting 1.2664, strengthening the bullish outlook. The final target will be 1.2692, where I will take profits.

If GBP/USD declines and lacks buyer activity at 1.2580, there is no immediate threat to buyers, but pressure on the pound will likely increase early next week. In this case, a false breakout around 1.2550 would be an ideal condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.2515, targeting an intraday correction of 30-35 points.

To Open Short Positions on GBP/USD:

Pound sellers attempted to show strength but did so rather modestly. There is little incentive for buyers as well, meaning trading will likely continue within a sideways range, which I will try to capitalize on. A false breakout around the 1.2627 resistance level will create an entry point for short positions, targeting a drop to 1.2580, where moving averages supporting bulls are located. A breakout and retest from below of this range would trigger stop-loss orders and open the path toward 1.2550. The final target will be 1.2515, where I will take profits.

If demand for the pound remains strong in the second half of the day after the Federal Reserve speeches and bears fail to act at 1.2627, the pair may continue to rise. In this case, it is best to wait for a test of the 1.2664 resistance before considering short positions. I will sell only after an unsuccessful consolidation. If there is no downward movement, I will look for short positions on a rebound from 1.2692, aiming for a 30-35 point correction.

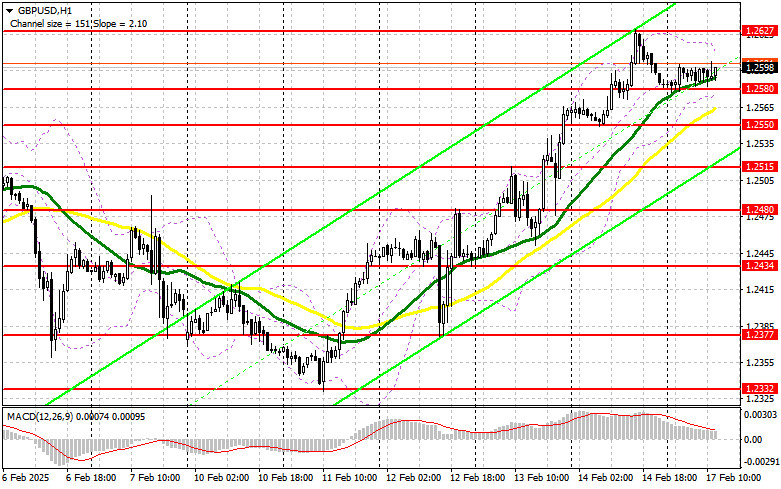

The Commitment of Traders (COT) report from February 4 showed a reduction in short positions and an increase in long positions. However, this should not be taken as a signal for sustained pound growth. The report does not account for the Bank of England's recent rate cut decision and its shift to a more dovish stance. The pound's recent rise has been merely a correction, while fundamental pressure on the pair remains. Additional measures from the U.S. administration will continue to weigh on risk assets while maintaining strong demand for the U.S. dollar.

According to the latest COT report, long non-commercial positions increased by 6,111 to 65,442, while short non-commercial positions decreased by 4,238 to 76,765. The gap between long and short positions narrowed by 356.

Indicator Signals

Moving Averages

The pair is trading above the 30- and 50-day moving averages, indicating further pound strength.

Note: The author uses H1 moving averages, which differ from the standard D1 moving averages.

Bollinger Bands

The lower boundary of the indicator around 1.2580 will serve as support in case of a decline.

Indicator Descriptions:

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise.

- 50-period MA: Marked in yellow on the chart.

- 30-period MA: Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period

- Slow EMA – 26-period

- SMA – 9-period

- Bollinger Bands: 20-period.

- Non-Commercial Traders: Speculators such as retail traders, hedge funds, and large institutions using the futures market for speculation.

- Long Non-Commercial Positions: The total long open positions held by non-commercial traders.

- Short Non-Commercial Positions: The total short open positions held by non-commercial traders.

- Total Non-Commercial Net Position: The difference between short and long positions held by non-commercial traders.