The EUR/USD currency pair mostly remained flat throughout Tuesday. Although both pairs are in an upward trend, the euro and the British pound have recently not been trading in sync. They seem to rise alternately. It's extremely difficult to determine the exact reason behind this behavior, especially since there were no significant events in either the Eurozone or the UK on Monday and Tuesday. Nevertheless, the pound maintained its steady rise over those two days.

What can be said about EUR/USD at the moment? Given that the pair is going nowhere, the conclusion is obvious: the market is waiting. And what could it be waiting for if traders in recent months have only been reacting to trade war news? Only new tariffs — either from the U.S. or from its trading partners. If the trade war escalates, the U.S. dollar will continue to fall. If signs of de-escalation appear, the dollar might start to strengthen. If there's no news, the price will likely remain in place.

The European Central Bank meeting scheduled for Thursday will unlikely influence traders' sentiment. To be clear, we're not saying the ECB rate cut won't impact the euro. Of course, Christine Lagarde's dovish tone could weigh on the euro. The ECB may lower its key rate to 2% and possibly even lower. Inflation is no longer a significant concern for the EU, while economic growth has been a problem for the past 2.5 years. Now is the time to start thinking about stimulating the economy.

If mutual trade deals cannot be reached, Trump's tariffs will spur inflation. However, this will also lead to a further economic slowdown. As we've said before, a 3% inflation rate is tolerable. But there's virtually no room left for the eurozone economy to slow further — any lower, and it's in recession. Europe wants to avoid a recession. Unlike the Fed, the ECB is not fully independent and must consider the views of the European Commission. Therefore, we expect the ECB to continue cutting rates through the end of 2025, although much depends on how the trade conflict unfolds.

Simply put, everything in the market now revolves around the trade war driven by the U.S. That's precisely why we believe an ECB rate cut won't change trader sentiment. The euro may fall on Thursday, but what happens next? If Trump announces new tariffs, the dollar will start falling again. And let's not forget — in just a few months, the dollar has lost 10 cents in value. That's a huge move for a global reserve currency. This kind of trend could even put its reserve status at risk.

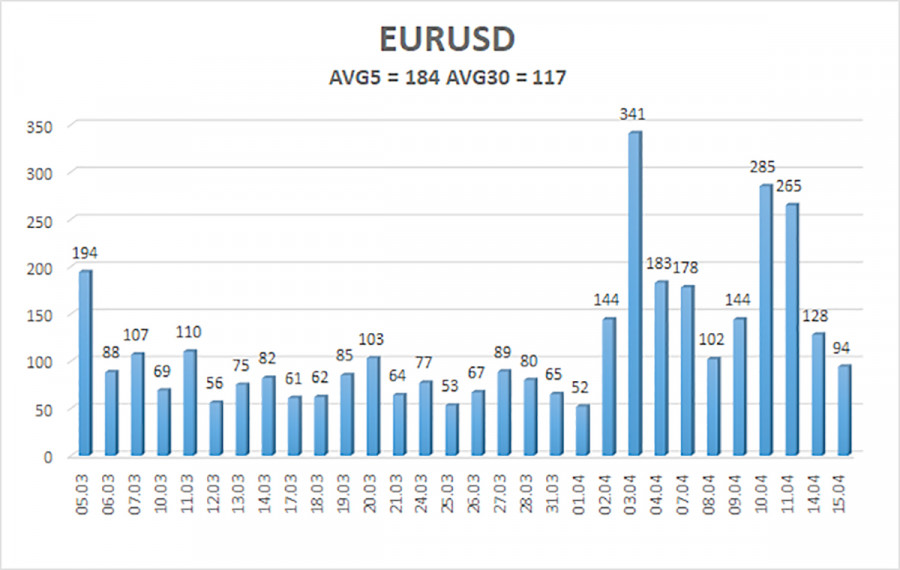

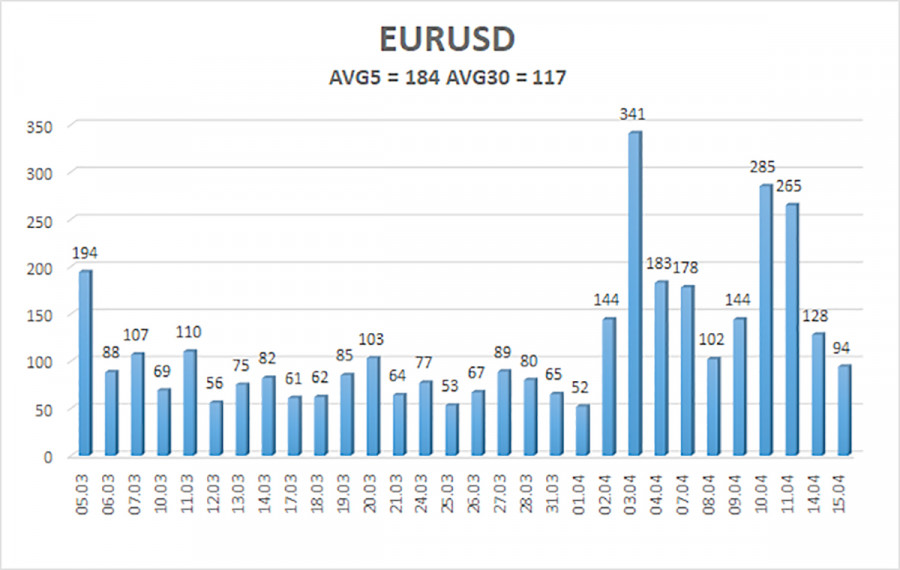

The average volatility of the EUR/USD pair over the last five trading days, as of April 16, is 184 pips, which is classified as "high." We expect the pair to move between 1.1106 and 1.1475 on Wednesday. The long-term regression channel is pointing upward, signaling a short-term bullish trend. The CCI indicator has entered the overbought zone twice, again signaling the possibility of a correction. A bearish divergence has also formed. However, the dollar could resume falling at any moment if Trump imposes new tariffs.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest Resistance Levels:

R1 – 1.1353

R2 – 1.1475

Trading Recommendations:

The EUR/USD pair remains in an upward trend. For several months, we have consistently stated that we expect the euro to fall in the medium term, and that view hasn't changed. The dollar has no fundamental reasons to decline, except for the influence of Donald Trump. But this single factor continues to drag the dollar down. Moreover, it's now wholly unclear what economic consequences this factor might bring. By the time Trump backs down, the U.S. economy may be in dire shape — making a dollar recovery even less likely.

If you're trading based on pure technicals or Trump-related sentiment, long positions may be considered once the price is above the moving average, targeting 1.1475.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.